01

Application and management of public aid for R&D&I including subsidies and/or loans

We fully manage the process of obtaining and managing public aid for innovative regional, Spanish and European projects, in the form of grants and/or loans, and in an individual or collaborative content.

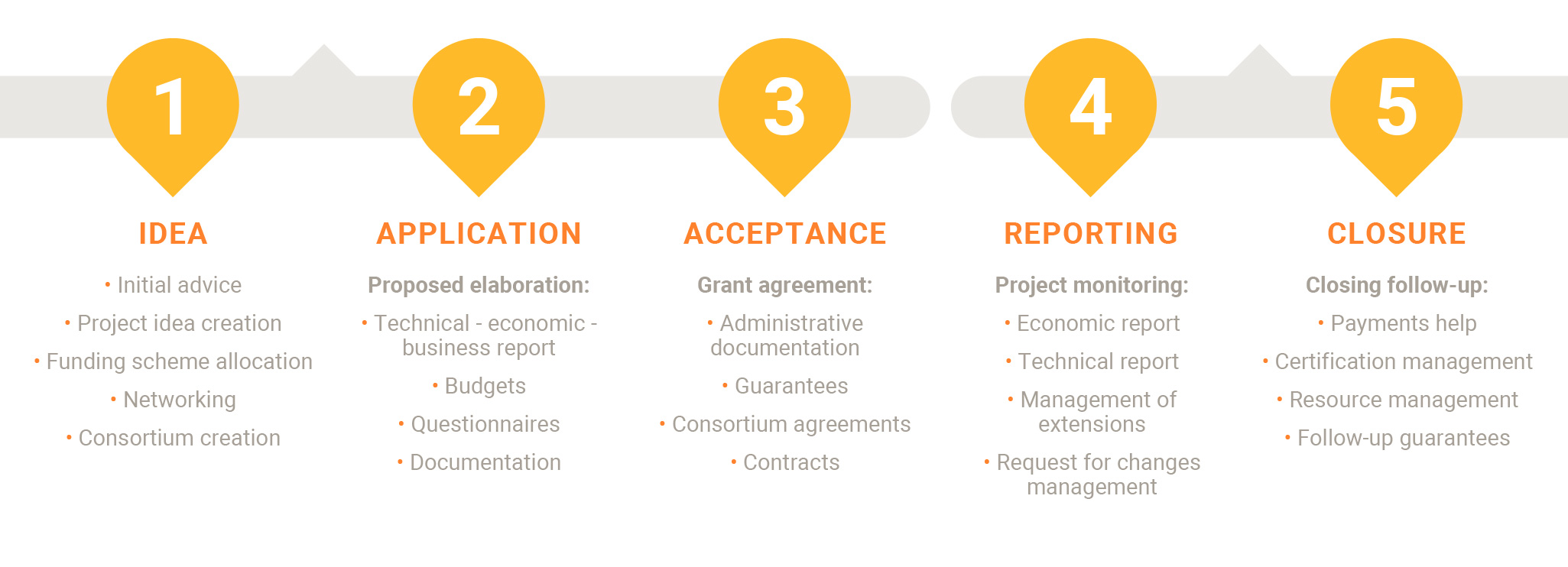

We accompany our clients throughout the process including: initial definition (idea), preparation of the proposal (application), processing (acceptance), follow-up (justification) and closure.

| IDEA An idea or investment of a defined project |

•We analyse the investments and innovative actions of our clients and define the different R&D&I projects and subsequent aid that our clients could receive financing within the framework of the different regional, state and European calls.

• We help with the creation of consortiums between companies and research organizations in order to improve the possibilities of project financing, increase innovation and facilitate future business opportunities. |

| APPLICATION (REQUEST) Preaparation and presentation of the project |

• Once the idea is defined, we collaborate in the preparation of the technical economic business report and complete the application questionnaires of the defined aid programs. • We coordinate the delivery of administrative and financial documentations, and review the budgets in relation to the characteristics of each program. • In relation to collaborative projects, we coordinate the drafting of the consortium, intellectual property and/or exploitation agreements that will susequently govern the consortium. • We coordinate the submission of completed applications and respond to the administration, in reference to all possible required documentation raised during the evaluation of the proposal. • If the program requires an evaluation visit, we coordinate its preparation and accompany the client on the day of the visit. • We follow the evolution of the project until its approval or denial. |

| ACCEPTANCE Acceptance of the granted founding. |

• In the approved projects we collect the administrative and financial documentation required for the project acceptance. • If the program requires guarantees, we help the client in its definition, search and negotiation with banks or Reciprocal Guarantee Societies (SGR). • If the program has partial or full assistance in the form of loans and can be subrogated, we help in negotiating the subrogation with banks. • In collaborative projects, we coordinate the preparation, negotiation and signing of consortium, intellectual property and/or industrial exploitation agreements. Likewise, if part of the project is subcontracted and according to the programs requirements, we also coordinate the preparation and negotiation of agreements with the subcontracted organizations. |

| REPORTING Technical-economic certification ofeach phase of the project |

• We monitor the technical-economic execution of the project, advise on the allocation of expenses and coordinate applications for modification of resolution and extensions in order to synchronize the execution of the project. • We monitor and coordinate aid payments when aid is made in advance. • We collaborate and coordinate the preparation of justifying financial reports for each member of the consortium in each phase or year of the project. • If the program requires a justification visit, we organize the preparation and accompany the client on the day of the visit. • We coordinate the presentation of all justifications responding to all possible requirements of documentation raised by the administration, from the review of justifications to the final certification of the project. |

| CLOSURE Project completion |

• We monitor and coordinate aid payments once the project has been certified.

• We provide assistance in the return of guarantees, inspections upon the project’s certification and/or in the presentation of administrative appeals. |

02

Tax incentives for R&D&I: Tax deductions and bonus schemes for research staff

We manage existing R&D&I tax incentives such as tax deductions and discounts on Social Security contribution for research staff.

We identify and process the different innovative projects in order to maximize tax savings, both for those projects financed in public calls, as well as those carried out entirely with funds of the organization.

03

Proposal of new opportunities of collaboration

We promote collaboration between organizations in order to generate new innovative projects, create business opportunities, optimize resources and improve the competitiveness of our clients.

We have a wide network of business partners, technology centres and universities.

Our team is in charge of:

Finding the right partners for each initiative.

Advising on the negotiation of consortium agreements, intellectual property and industrial exploitation of project results.

Coordinating the elaboration of the proposal.

Collaborating in the execution of the project report and individualised monitoring of the administrative and legal documentation of each organization.

Processing the acceptance of the aid and advising on the search for joint or individual guarantees at the request of the administration or the consortium in question.

Collecting the results of each phase or annuity of the project.

Collaborating in the elaboration of the justifying technical-economic report.

Carrying out individualised monitoring of the economic justification of each organization.

Preparing the financial report justifying each organization.

Organizing and attending the plenary meetings of each phase of the project.

Support with all communications between the leader and the public aid agency.

04

Consultancy in the definition of innovative projects

We help organizations to define, document and plan innovative ICT projects from the beginning, for both projects financed at a public level, as well as those of innovative public purchasing or projects without public founding.

How do we work?

We carry out a market study and analyse the competition.

We define an innovative proposal that generates new business opportunities.

We perform an economic and financial analysis in order to evaluate the projects viability and sustainability.

We study the various calls available for regional, state and European public aid for R&D&I that may finance the project.

We seek cooperation with other organizations that have common goals.

We provide technical solutions.

We define the work schedule and tasks to be performed so as to carry out the project.

05

Coordination and technical monitoring of innovative projects

We coordinate and technically monitor innovative projects and help organizations to put them into practice according to the objectives and the initially defined plan.

How do we work?

We create a roadmap that determines the set of actions to be carried out, their management and delivery times.

We identify possible grants for regional, state and European R&D&I for the development of the project.

We schedule regular meetings with the project team. Communication is essential so that all parties are informed of the progress made.

We supervise the execution of project activities and their evolution by generating monitoring reports.

We coordinate necessary changes in order to improve the outcome of the project.

We recommend preventative actions in order to anticipate possible problems.

We celebrate success together with our clients.